ประกันสุขภาพ Health LTR Plan

Start THB13,102 per year (Age 20-39 years old for Plan2)

จุดเด่น

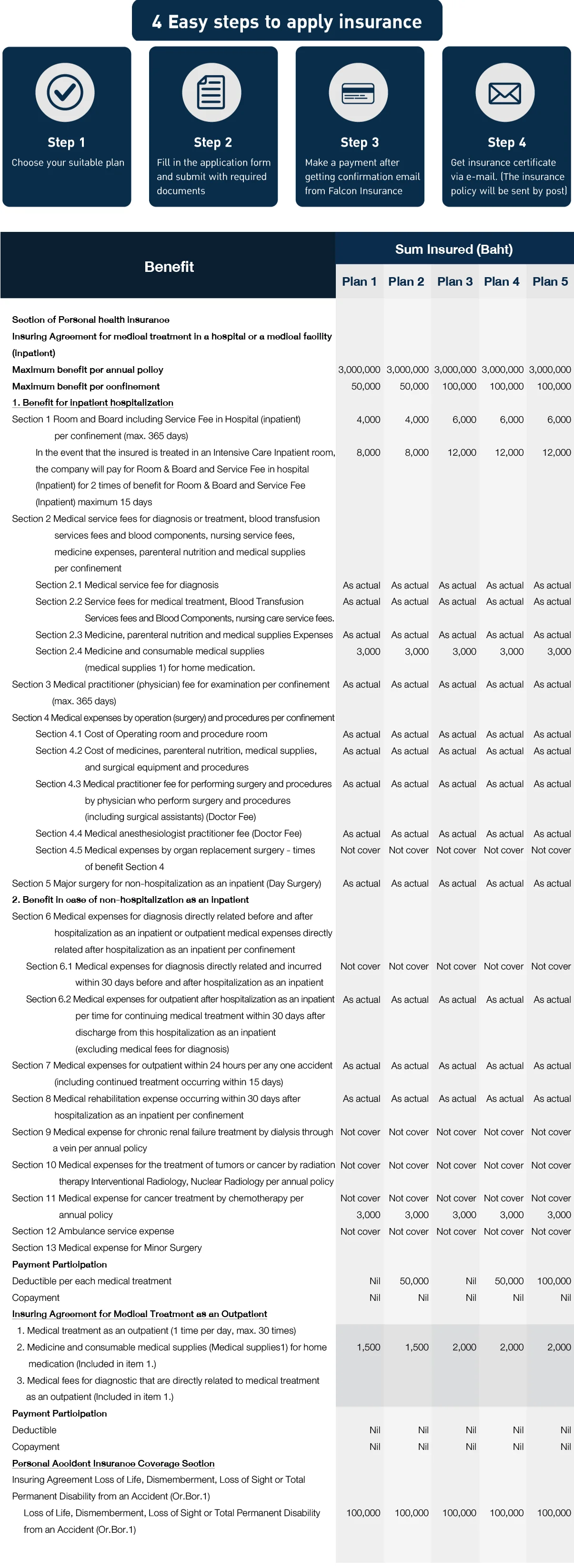

แผนความคุ้มครอง

Insurance terms & Conditions :

1. Qualifications of the insured

1.1 The insured wishes to apply for Thailand’s Long Term Resident Visa.

1.2 Insured must be between 30 days – 70 years old (can be renewed up to 80 years old)

“The insured under 10 years old must purchase with at least one parent (father/mother).

If the insured purchased with a relative such as uncle, or aunt, the evidence that they live in the same house or the same last name is required and the insured must purchase an insurance plan that provides coverage lower than or equivalent to the parent.”

1.3 Applicant must be healthy and not crippled and has no serious underlying diseases.

2. Insurance premiums will increase according to age band.

3. The company will cover the benefit of Medical Expenses from accident since the effective date of this insurance policy.

4. This insurance will not pay the benefits for any sickness during the first 30 days from the first policy commencement date of this insurance policy.

5. This insurance will not pay the benefits during the first 120 days from the first commencement date of this insurance policy for the following diseases : Benign, Malignant tumor, Cancer, Cystic mass, Hemorrhoids, Hernias, Pterygium, Pinguecula, Cataract, Tonsillectomy or Adenoidectomy, Stones, Varicose Veins, and Endometriosis.

6. Inpatient expenses are payable for any one disability. If a covered person receives continuous treatment in connection with or in relation to one previous injury or sickness, those treatments will be counted as the same disability unless such treatments occur not less than 90 days after the last treatment date in the case of last hospitalization.

7. An Accident while driving or riding the motorcycle is excluded from Insuring Agreement for Loss of Life, Dismemberment, Loss of Sight or Total Permanent Disability from an Accident (Or.Bor.1)

Major Exclusions of Personal Health and Accident Insurance :

This insurance does not cover the cost of treatment or losses arising from injury or illness

(including complications thereof) symptoms or conditions arising from the following :

1. Injury or illness including chronic conditions and symptoms that occurred prior to the first policy effective date.

2. Pre-existing conditions, congenital abnormalities, growth development abnormalities,

and genetic disorders.

3. Any cosmetic surgery or beautification treatment including treatment of acne, freckles, dandruff, weight reduction and weight gain, hair loss. Reconstructive surgery is also excluded unless injury is sustained as a result of an accident.

4. Services in connection with infertility, pregnancy, childbirth, abortion or miscarriage,

or any causes related to pregnancy, sterilization or investigation of sterilization.

5. AIDS or sexually transmitted diseases or sexually transmitted diseases.

6. Treatment to relieve symptoms commonly associated with aging, menopause or precocious puberty, sexual dysfunction of sex change.

Remarks :

1. The Company reserves the right to reject any application or accept with exclusions (if any), according to underwriting standard of Company.

2. Term and Conditions of underwriting as specified by the company. The insured should understand before making the decision.

3. This document is not an insurance contract, all conditions shall be referred to definitions, General Conditions, and Exclusions of the Special Personal Health and Accident Insurance Policy.

4. The English language used in this document is merely a translation of Thai Version.

ผลิตภัณฑ์ที่คุณอาจสนใจ

- เบี้ยประกันเริ่มต้น2฿ต่อวัน

- คุ้มครองสูงสุด1,000,000฿

ความคุ้มครองพิเศษ

- เบี้ยประกันเริ่มต้น฿13,102 per year

- คุ้มครองสูงสุด0฿